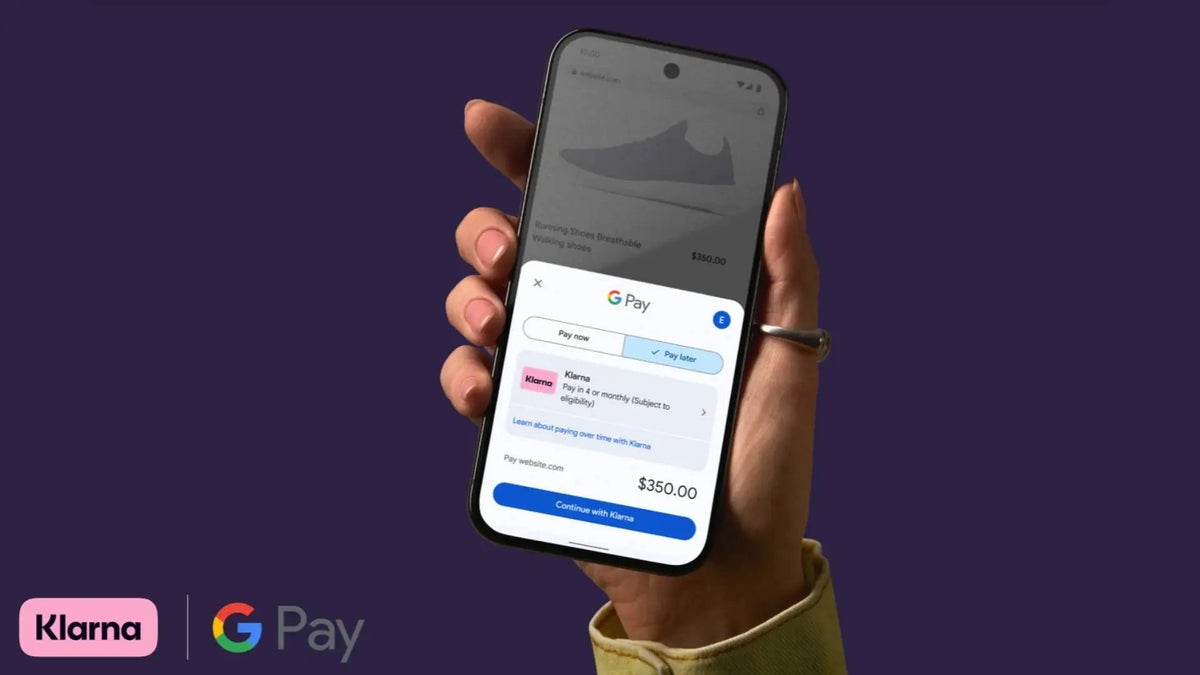

Google Pay has officially added Klarna to its buy now, pay later (BNPL) roster in the U.S., giving Android users more flexibility when paying for larger purchases. The integration is now live and brings Klarna’s Pay in 4 and financing plans to select Android apps and websites that support Google Pay at checkout.

Klarna is now live in Google Pay

The new integration allows users to split eligible purchases over $35 into four interest-free payments, or opt for long-term financing on more expensive items. Klarna’s financing terms start at 0% APR, depending on the user’s credit profile and the merchant.

This move rounds out Google Pay’s BNPL ecosystem, which already includes Affirm, Zip, and Afterpay. It also comes at a time when Klarna is expanding far beyond payments.

Klarna’s ecosystem keeps growing

From payments to phone plans — Klarna is evolving into an all-in-one lifestyle and financial hub. | Image credit — Klarna

Just days before this integration went live, Klarna made headlines by entering the U.S. mobile carrier market with a new $40/month unlimited 5G plan. The mobile service runs on AT&T’s network, and it promises hassle-free setup with no activation or cancellation fees, as well as eSIM support. All of this is fully managed from the Klarna app.

As we shared in our earlier coverage, the service is built on Gigs’ mobile infrastructure and will eventually expand to other countries, including the UK, Germany, and more. Klarna has more than 25 million active U.S. users as of this moment, which makes it well-positioned to cross-sell services across payments and mobile connectivity.

Now that Klarna’s baked into Google Pay and even selling phone plans, it’s clear the company isn’t just about splitting payments anymore — it’s without a doubt trying to become a one-stop shop for everything from purchases to telecommunication.